Vehicle Finance

Drive away with your perfect vehicle with our personalised deals

Leodis Financial provides a variety of car financing options to help you get into your next vehicle

without the hassle.

without the hassle.

Car Finance

“Car Finance made Simple, We Shall Help You Find the Right Deal.”

Our Car Finance solutions help you achieve your dreams, with finance available for almost any car.

Our varied panel of lenders caters to both new and used vehicles, and our team of professionals will assist you in finding the best financing option for your next purchase.

Choose from our Hire Purchase, Lease Purchase, or Personal Contract Purchase options, all of which are tailored to your specific requirements.

“Classics, High Performance, Super-cars, Collectibles.”

Our finance deals can be adapted to specific needs and are available for individuals, sole traders, limited corporations, and high net-worth individuals, whether you’re searching for Ferrari or a KIA.

Why should you use Leodis Financial?

-

Finance choices that are more appealing than the dealer's in-house financing, which is generally more Expensive.

-

All of the available funding alternatives - Personal Contract Purchase (PCP), Hire Purchase, and Lease Purchase Are all examples of personal contract purchase.

-

To identify the proper funding product for you, you'll need to talk to a few different funders.

-

Advances ranging from £3k to £500k are available.

-

Service that is quick, polite, and personalised

-

Those who desire to change their vehicle more frequently may appreciate the flexibility.

-

Lower rates than dealers, allowing you to stretch your budget.

Please note that, Leodis Financial is not a lender, but rather a credit broker. We provide new and used car finance through reputable lenders and banks, many of which we have worked with for many years.

“We only work with reputable lenders and banks in getting the finest rates possible.”

We work with trusted lenders and banks that consider yourself for the loan; this provides you with the widest chance of being accepted at the lowest rate possible based on your criteria, all in one easy application process!

Contact Us Now.

Are you new to car finance?

Purchasing a new or used car on credit is a cost-effective option to get your first car or upgrade to a newer model.

Our car finance calculator is a terrific way to figure out how much you can afford to pay each month, and there are no obligations with any of our car finance rates.

Our customer care team is brilliant, they go out of their way to ensure that you are happy with your decision. After all, such a big purchase should be enjoyable rather than stressful. We’re here to advise you and assist you in getting the finest price possible.

You’re not sure what kind of financing you want?

Take a look at the pages for each of the Finance Products below to learn more about the many types of financing options available at Leodis Financial.

“Use the calculators to construct your own custom car finance package.”

Use the calculators to construct your own custom car finance packages, and then call us to customise your terms. Among the services we provide are PCP, Hire Purchase, Lease Purchase and Car Refinance.

“We’ll give you a quick and accurate financial quote.”

We’ll give you a quick and accurate financial example. Alternatively, if you require something more bespoke for example, a finance plan for a classic, sports, or super car that you are unable to design using our finance calculator, please contact our customer care team, who will be happy to give a bespoke solution.

Compare the best vehicle financing packages available right now and get a decision in minutes without making a mark on your credit history.

There is no one-size-fits-all financial solution that is right for everyone when purchasing a vehicle on finance. So what we have managed to do at Leodis Financial is offer you a range of products to make sure your financial deal suits your needs and budget.

HP Finance

Finance your vehicle for upto 60 months. Find out more

Conditional Sales

Own your vehicle at the end of the agreed term. Find out more

PCP Finance

Flexible car financing over a maximum of 48 months. Find out more

PCH Lease

Drive a new car every few years. Find out more

Car Refinance

Help to pay a car finance outstanding balance. Find out more

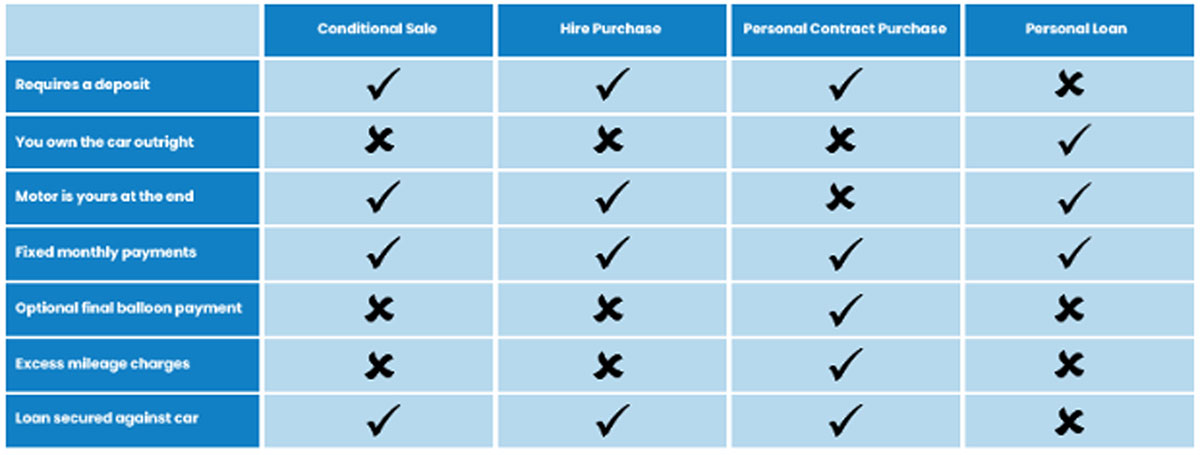

Compare Products

Lets look at which one suits your needs best! Find out more

Another way to buy a car is to use car finance, it entails borrowing money for your car from a lender and repaying it with interest over a period of time that is convenient for you.

Instead of paying the full price of a car up front, you can finance it and spread the expense over time.

There are several different types of car loans available to meet different needs, with Hire Purchase (HP) and Personal Contract Purchase (PCP) being the most popular.

Most of the lender and banks are willing to be flexible with the types of car loans they offer. For example, we offer choices for people with bad credit and zero-down deposit car finance plans that make the new/ newer car more affordable to purchase.

Instead of paying the full price of a car up front, you can finance it and spread the expense over time.

There are several different types of car loans available to meet different needs, with Hire Purchase (HP) and Personal Contract Purchase (PCP) being the most popular.

Most of the lender and banks are willing to be flexible with the types of car loans they offer. For example, we offer choices for people with bad credit and zero-down deposit car finance plans that make the new/ newer car more affordable to purchase.

We conduct a gentle credit search to obtain a quote from you, a soft credit check is a preliminary credit check that is used to determine if you are qualified for certain lenders’ products.

This type of credit check has no bearing on your credit score and is not shared with any potential lenders, only with us. Only when you opt to purchase a product will your credit score and history be shared with a lender, and the lender you choose to purchase from will then do a full/hard credit check.

This type of credit check has no bearing on your credit score and is not shared with any potential lenders, only with us. Only when you opt to purchase a product will your credit score and history be shared with a lender, and the lender you choose to purchase from will then do a full/hard credit check.

The paperwork you’ll require will differ depending on the lender, most UK lenders and banks will ask to see a few pieces of papers.

All lenders will want you to be able to demonstrate that any personal information you’ve provided is correct. You should expect to be asked for a photo of your driver’s licence or passport.

Payslips or other proof of income may be required by the lender to ensure that you can afford the payments. Leodis Financial will propose the best lender from its panel for you, and then tell you exactly what they require!

All lenders will want you to be able to demonstrate that any personal information you’ve provided is correct. You should expect to be asked for a photo of your driver’s licence or passport.

Payslips or other proof of income may be required by the lender to ensure that you can afford the payments. Leodis Financial will propose the best lender from its panel for you, and then tell you exactly what they require!

The overall charge for borrowing, including any fees and charges, is known as the annual percentage rate (APR). After your information has been verified, the lender will quote you an exact APR. As a result, the price you see is the amount you’ll pay, with no hidden costs.

You can choose a vehicle from any respectable UK VAT registered dealer; we have worked with a number of dealers in the past who have met our risk requirements. We put a lot of time and effort into our dealer checks to safeguard you from future difficulties.

The ideal car financing choice for you will be determined by your unique circumstances, the vehicle you want to purchase, and how you want to use it.

You’ll own the car at the end of your loan term if you choose HP finance, but your monthly payments may be higher than other options, and you won’t be able to sell or trade it in during your agreement.

You can do everything you want with your new car if you take out a personal loan, but your monthly payments may be more.

PCP car finance has the lowest monthly payments, but you may be required to agree to mileage restrictions and you will not automatically own the vehicle at the end of the loan term.

You’ll own the car at the end of your loan term if you choose HP finance, but your monthly payments may be higher than other options, and you won’t be able to sell or trade it in during your agreement.

You can do everything you want with your new car if you take out a personal loan, but your monthly payments may be more.

PCP car finance has the lowest monthly payments, but you may be required to agree to mileage restrictions and you will not automatically own the vehicle at the end of the loan term.

You have to be over the age of 18 and have lived in the UK for at least 3x years.

Hire Purchase is a type of finance that allows you to buy a car outright without having to pay the whole amount upfront and with no large final payment; you’d be splitting the cost across a deposit and a series of fixed monthly installments. When all the payments are made, the Hire Purchase agreement ends and you own the car.

“Want to own your vehicle outright but with affordable monthly installments and no large final payment?”

You shall own the vehicle as soon as you’ve made the final installment. While PCP finance involves lower monthly payments for the same car, drivers looking to own the car at the end of the contract will pay less overall with Hire Purchase.

Drivers also don’t have to find a substantial amount of money to pay a very large final payment, known as the optional final payment which is needed to own the car with Hire Purchase as they would with PCP.

“Want to own your vehicle outright but with affordable monthly installments and no large final payment?”

You shall own the vehicle as soon as you’ve made the final installment. While PCP finance involves lower monthly payments for the same car, drivers looking to own the car at the end of the contract will pay less overall with Hire Purchase.

Drivers also don’t have to find a substantial amount of money to pay a very large final payment, known as the optional final payment which is needed to own the car with Hire Purchase as they would with PCP.

Advantages of HP Finance

- It’s simple to understand and organised.

- Drive a vehicle that you would normally not be able to purchase outright.

- You own the vehicle once all payments are made.

- You don’t need to estimate your mileage at the beginning of the purchase, you’ll be avoiding the excess mileage charges.

- It allows you to stretch the expense of the vehicle over time, allowing you to have a better vehicle than you could with an upfront purchase.

- It’s a flexible agreement with maturities ranging from one to five years.

- The vehicle manufacturer may give a deposit contribution.

- Because the vehicle is considered collateral, HP may be easier to obtain than a traditional loan if you have a bad credit history.

Disadvantages of HP Finance

- The vehicle needs to be insured and highly maintained in the owner’s care until the HP finance agreement has been fully paid.

- Monthly payments are higher than other finance options available such as PCP but you shall be paying off the full value of the vehicle.

- You can’t sell and own the vehicle without settling the finance.

- You do not own the vehicle until the final payment is made.

- Monthly payments are higher as compared to leasing and personal contract plans (PCPs).

- Rates are typically higher than those on normal car loans.

- You can’t modify or sell the vehicle without the financing company’s authorization during the period of your contract.

- Failure to make payments may result in the vehicle being repossessed by the credit company.

- They can do this without a court order until a third of the entire amount is paid.

There are two options of ending the HP finance deal early, a “voluntary termination” and the 2nd being the “paying off early”.

Voluntary termination – Like with PCP finance, you can return the vehicle back to the finance company without paying anything more if you have covered half or more of the total finance agreement.

Paying off early – If you have a lump sum to invest, you can pay off your vehicles finance and become the owner of the car. Your settlement figure will be the outstanding amount of the loan plus a fee, which can’t be charged if you’re only repaying early £8,000 or less. If you’re repaying more, the fee is capped to the lower between:

Hire Purchase is finance that allows you to buy a car outright without having to pay the whole amount upfront and with no large final payment, you’d be splitting the cost across a deposit and a series of fixed monthly installments.

There are no mileage restrictions or final balloon payments to pay, once all repayments have been made, the vehicle is yours.

Use the HP calculator; enter the amounts to give yourself an idea on what the monthly payments will be but please remember these are only estimates and to be used as a guide only.

We also show the estimate value of the tax saving on the loan amount, for businesses HP finance is the most tax-efficient option when it comes to purchasing of equipment, including cars, vans, trucks, etc.

You can get tax relief on all hire purchases, if you are VAT registered, you can reclaim the VAT at the purchase date, please speak with your accountant or financial adviser for further details.

Voluntary termination – Like with PCP finance, you can return the vehicle back to the finance company without paying anything more if you have covered half or more of the total finance agreement.

Paying off early – If you have a lump sum to invest, you can pay off your vehicles finance and become the owner of the car. Your settlement figure will be the outstanding amount of the loan plus a fee, which can’t be charged if you’re only repaying early £8,000 or less. If you’re repaying more, the fee is capped to the lower between:

- 1% of the amount paid early (or 0.5% if you’ve entered the last 12 months of the loan).

-

- The remaining interest.

Hire Purchase is finance that allows you to buy a car outright without having to pay the whole amount upfront and with no large final payment, you’d be splitting the cost across a deposit and a series of fixed monthly installments.

There are no mileage restrictions or final balloon payments to pay, once all repayments have been made, the vehicle is yours.

Use the HP calculator; enter the amounts to give yourself an idea on what the monthly payments will be but please remember these are only estimates and to be used as a guide only.

We also show the estimate value of the tax saving on the loan amount, for businesses HP finance is the most tax-efficient option when it comes to purchasing of equipment, including cars, vans, trucks, etc.

You can get tax relief on all hire purchases, if you are VAT registered, you can reclaim the VAT at the purchase date, please speak with your accountant or financial adviser for further details.

Hire-Purchase is one of the easiest ways to fund the purchase of a vehicle. In essence you will be spreading the cost of the vehicle over a set period of time. At the end of the set period of time and if you have paid all of the monthly instalments on time and in full then on the payment of the final monthly instalment, you own the car and there is no need to pay any further monies.

Hire-Purchase is essentially a contractual commitment to you owning your own vehicle. You will need to be able to fund a deposit for the vehicle and then commit to a number of set monthly payments ranging from 12 months to 60 months. Once you have paid the final instalment of your monthly payments then the vehicle’s ownership will be transferred to you. A number of finance providers will have a set fee ranging from £100.00 to £150.00 for the administration of documentation to transfer the vehicle to you however this does vary according to the finance provider that is utilised.

Advantages of Hire-Purchase

Advantages of Hire-Purchase

- It is not necessary to save money for a large payment as there is no balloon payment at the end of the Term.

- The payment term can be agreed at the outset to minimise the amount required to be paid each month.

- There is no maximum amount of mileage that you can do or a financial penalty if you exceed the amount of miles originally estimated at the outset.

- Not all financial companies offer Hire-Purchase as an option to purchase your vehicle.

- There is no option to purchase the vehicle at the end of the term – you are committed to purchasing the vehicle at the outset.

- The monthly payments can be higher than other forms of vehicle finance as you are spreading the cost of owning the vehicle at the outset and will not have to pay a large payment at the end of the term to own the vehicle.

After you’ve made all of your payments, you’ll need to pay an option to purchase charge to transfer vehicle ownership to you. Your HP agreement will include this information, as well as the stated cost, which is normally between £100 and £200 – please check the terms and conditions of the contract before agreeing with the advisor, they will be able to inform you of the exact fee that will be paid for the release.

Remember that the finance company still owns the vehicle until you make both your final payment and your option to purchase fee. It is prohibited to sell the car before you have made these two payments.

It’s likely that the finance company with whom you have an HP agreement may allow you to sell their vehicle if the entire amount owed has been paid in full first.

You can return the car to the finance company once you’ve paid off half of the total debt. This is referred to as a “voluntary termination.” You can get out of an HP arrangement sooner thanks to a section in the Consumer Credit Act. To be eligible for this, you must have paid at least half of the total amount owed. You can then terminate your contract and return the vehicle to the credit company.

In a Hire Purchase agreement, this clause can be useful to you if:

If you decide to end your contract early, make sure you acquire formal confirmation from the lenders, and save copies as documentation in case you are accused of defaulting.

All lending is subject to status checks and an affordability assessment.

Remember that the finance company still owns the vehicle until you make both your final payment and your option to purchase fee. It is prohibited to sell the car before you have made these two payments.

It’s likely that the finance company with whom you have an HP agreement may allow you to sell their vehicle if the entire amount owed has been paid in full first.

You can return the car to the finance company once you’ve paid off half of the total debt. This is referred to as a “voluntary termination.” You can get out of an HP arrangement sooner thanks to a section in the Consumer Credit Act. To be eligible for this, you must have paid at least half of the total amount owed. You can then terminate your contract and return the vehicle to the credit company.

In a Hire Purchase agreement, this clause can be useful to you if:

- You don’t need a car any longer.

- You must cut your expenses.

- You are unable to make your payments.

- You find a car that costs less than the total number of payments left on your contract plus your option to purchase fee.

If you decide to end your contract early, make sure you acquire formal confirmation from the lenders, and save copies as documentation in case you are accused of defaulting.

All lending is subject to status checks and an affordability assessment.

Personal Contract Purchase finance packages is spreading the cost of the vehicle across a deposit, paying a series of monthly payments and with an optional final payment.

“The most common method of financing a car is through a personal contract purchase (PCP). It’s a way to pay for a car over three or five years, and then most people don’t go on to buy the vehicle.”

If you prefer to split your vehicle’s cost into monthly payments, then have the option to buy or not in the future, then PCP vehicle finance is the best option, it is the most common type of finance for new vehicles, with our clients loving the simplicity and options it provides yourself.

With a PCP finance package, the monthly installments are used to pay off the depreciation of the vehicle and not its value over the course of the term, basically the difference between the initial price and what the vehicle is expected to be worth when you hand it back. At the end of the PCP agreement, there is a final balloon payment that needs to be made if you want to keep the vehicle.

“The most common method of financing a car is through a personal contract purchase (PCP). It’s a way to pay for a car over three or five years, and then most people don’t go on to buy the vehicle.”

If you prefer to split your vehicle’s cost into monthly payments, then have the option to buy or not in the future, then PCP vehicle finance is the best option, it is the most common type of finance for new vehicles, with our clients loving the simplicity and options it provides yourself.

With a PCP finance package, the monthly installments are used to pay off the depreciation of the vehicle and not its value over the course of the term, basically the difference between the initial price and what the vehicle is expected to be worth when you hand it back. At the end of the PCP agreement, there is a final balloon payment that needs to be made if you want to keep the vehicle.

Having a PCP finance agreement gives you the options of affording a newer vehicle with more manageable monthly payments and the options of handing the vehicle back and having nothing else to pay at the end of the contract, the vehicle has to be in good condition, with below the agreed mileage limit and the servicing has to be kept up to date with the vehicles manufacturing guidelines.

“PCP splits price of vehicle into affordable manageable chunks, deposit, monthly payments and final payment, return the vehicle, buy it outright or trade it in.”

If you rather pick the option of buying the vehicle outright, you simply make the optional final payment.

Or, you can trade the vehicle in for a new one, taking advantage of any equity you may have built, should the car be worth more than the optional final payment needed to buy it, can be used as part of the deposit on a newer vehicle.

“PCP finance makes it easier to drive around in the vehicle of your dreams with none of the annoying hassles and large monthly payments of a loan.”

PCP does not mean you are tied you into the car dealers, you don’t have to keep purchasing future vehicles from them, if you were to find a better deal on a vehicle at another car dealer, they can pay the optional final payment to buy your car from the finance company, treating it like a part exchange and you still benefit from any equity available.

“PCP splits price of vehicle into affordable manageable chunks, deposit, monthly payments and final payment, return the vehicle, buy it outright or trade it in.”

If you rather pick the option of buying the vehicle outright, you simply make the optional final payment.

Or, you can trade the vehicle in for a new one, taking advantage of any equity you may have built, should the car be worth more than the optional final payment needed to buy it, can be used as part of the deposit on a newer vehicle.

“PCP finance makes it easier to drive around in the vehicle of your dreams with none of the annoying hassles and large monthly payments of a loan.”

PCP does not mean you are tied you into the car dealers, you don’t have to keep purchasing future vehicles from them, if you were to find a better deal on a vehicle at another car dealer, they can pay the optional final payment to buy your car from the finance company, treating it like a part exchange and you still benefit from any equity available.

At the beginning of the PCP contract, a Guaranteed Future Value of the vehicle is set, which is the car’s expected value when your PCP contract ends.

This means that the money you’re repaying is the difference between what the car is worth now and what it will be worth at the end of your PCP agreement, that is the depreciation plus interest, which is calculated on the full value of the vehicle, you’ll be paying the difference off in monthly installments.

Remember: you are still liable for the full amount of the vehicle if anything happens to the vehicle or if you settle early.

This means lower monthly payments for you, but you will need to pay a final payment at the end (the Guaranteed Future Value) if you want to keep the car.

Once your agreement is finished, you’ll have three options:

If you rather pick the option of buying the vehicle outright, you simply make the optional final payment.

Or, you can trade the vehicle in for a new one, taking advantage of any equity you may have built, should the car be worth more than the optional final payment needed to buy it, can be used as part of the deposit on a newer vehicle.

“PCP finance makes it easier to drive around in the vehicle of your dreams with none of the annoying hassles and large monthly payments of a loan.”

PCP does not mean you are tied you into the car dealers, you don’t have to keep purchasing future vehicles from them, if you were to find a better deal on a vehicle at another car dealer, they can pay the optional final payment to buy your car from the finance company, treating it like a part exchange and you still benefit from any equity available.

This means that the money you’re repaying is the difference between what the car is worth now and what it will be worth at the end of your PCP agreement, that is the depreciation plus interest, which is calculated on the full value of the vehicle, you’ll be paying the difference off in monthly installments.

Remember: you are still liable for the full amount of the vehicle if anything happens to the vehicle or if you settle early.

This means lower monthly payments for you, but you will need to pay a final payment at the end (the Guaranteed Future Value) if you want to keep the car.

Once your agreement is finished, you’ll have three options:

- Buy the car by paying the final balloon payment.

- Hand the vehicle back, the finance company has predicted the Guaranteed Future Value of the car, so handing the car back will settle the deal.

- Part exchange for a new car.

If you rather pick the option of buying the vehicle outright, you simply make the optional final payment.

Or, you can trade the vehicle in for a new one, taking advantage of any equity you may have built, should the car be worth more than the optional final payment needed to buy it, can be used as part of the deposit on a newer vehicle.

“PCP finance makes it easier to drive around in the vehicle of your dreams with none of the annoying hassles and large monthly payments of a loan.”

PCP does not mean you are tied you into the car dealers, you don’t have to keep purchasing future vehicles from them, if you were to find a better deal on a vehicle at another car dealer, they can pay the optional final payment to buy your car from the finance company, treating it like a part exchange and you still benefit from any equity available.

- PCP finance enables you to drive the latest and most prestigious car models in the market because only a small upfront fee is required accompanied by fixed monthly payments.

- There is less financial risk with a PCP, you are not paying for the entire cost of the vehicle. As previously mentioned, a PCP only entails a fixed monthly payment on the life of the PCP agreement. At the end of the contract, the final purchase is optional and the car buyer is given the chance to actually own the car by paying a specified sum of money or use it as a deposit for your next car.

- Unlike a loan that requires you to make a down payment, a PCP car lease only requires a small deposit amount.

- You don’t need to worry about selling or disposing your old PCP car when deciding to get a newer vehicle at the end of the contract.

- Car enthusiasts who take pride in vehicle ownership will think twice about a PCP finance deal, as the vehicle is legally owned by the finance company. The car will be yours if you opt to pay the final payment at the end of the PCP agreement. But by this time, new car models are already introduced in the market and a new PCP could be taken advantage of.

- You are entitled to stay within the annual mileage chosen upfront. You will be charged mileage fees for any excess mileage occurred when you decide not to purchase the car at the end of the PCP agreement.

- You are not allowed to perform modifications to the car unless authorized by the finance company. If you modified the vehicle without permission, you will pay penalty charges if you decide not to buy the car at the end of the PCP agreement.

- There will also be a penalty fee imposed on the PCP agreement if you decide to cancel the contract and return the car.

You can settle your PCP finance deal early; however the finance company will require you to pay off the difference between what your car is worth now, and what you still owe in negative equity.

Although, you may find that at the end of your term your car is worth more than the Guaranteed Future Value, which means you’ll have some positive equity to contribute towards your next car.

Simply put, the answer is “yes” you can cancel any PCP or HP finance agreement early, you can hand the vehicle back to the car dealers and walk away from the agreement under your legal rights.

You must have paid at least 50% of the total amount you owe that includes any interest and fees acceptable in the terms and the vehicle must be kept in good condition, if you have not taken reasonable care of the vehicle you will not be able to return the car back to the dealers.

If these conditions are met, you can sign the car back over to the dealer through a voluntary termination clause with no more payments to make.

Although, you may find that at the end of your term your car is worth more than the Guaranteed Future Value, which means you’ll have some positive equity to contribute towards your next car.

Simply put, the answer is “yes” you can cancel any PCP or HP finance agreement early, you can hand the vehicle back to the car dealers and walk away from the agreement under your legal rights.

You must have paid at least 50% of the total amount you owe that includes any interest and fees acceptable in the terms and the vehicle must be kept in good condition, if you have not taken reasonable care of the vehicle you will not be able to return the car back to the dealers.

If these conditions are met, you can sign the car back over to the dealer through a voluntary termination clause with no more payments to make.

There are three options to choose from when your PCP term ends:

RETURN THE VEHICLE

First option is, you can own the vehicle by paying off the balloon payment. You can claim outright possession once the payment has been made, please note that lenders may charge an extra fee of up to £500 for the transfer, either check the terms and conditions or speak with the advisor.

Second, you have the option of returning the vehicle and leaving. There will be nothing left to pay unless the vehicle is in poor condition or you’ve over the mileage restriction.

You won’t be able to collect the remaining equity in cash until you first make a balloon payment on the vehicle and then sell it.

A great financial advantage of a PCP finance agreement is when the car’s value has dropped more than expected by the end of your PCP arrangement, you can simply return it and let the loan company deal with the decrease in value.

RETURN THE VEHICLE

- Return the car to the finance company within the terms of your agreement

- Pay the balance owing on the finance agreement and keep the vehicle

- Swap your current vehicle for a new one and new agreement

First option is, you can own the vehicle by paying off the balloon payment. You can claim outright possession once the payment has been made, please note that lenders may charge an extra fee of up to £500 for the transfer, either check the terms and conditions or speak with the advisor.

Second, you have the option of returning the vehicle and leaving. There will be nothing left to pay unless the vehicle is in poor condition or you’ve over the mileage restriction.

You won’t be able to collect the remaining equity in cash until you first make a balloon payment on the vehicle and then sell it.

A great financial advantage of a PCP finance agreement is when the car’s value has dropped more than expected by the end of your PCP arrangement, you can simply return it and let the loan company deal with the decrease in value.

The most popular way our clients are purchasing their new car is through a PCP finance deal, the PCP calculator above will give you an idea how the finance works.

Enter the amounts to give yourself an idea on what the monthly payments will be but please remember these are only estimates and to be used as a guide, you shall have to check what the balloon/ final payment will be at the end, which is normally between 45% and 55% of the original value of the vehicle.

An example, if you were to borrow £30,000.00 over 3 x years with a balloon/ final payment of £17,000.00, your PCP loan amount shall be £13,000.00 and monthly payments will be approximately £400.00 taking in account interest rates and fees.

Please note that the more mileage you use, the higher the final balloon payment shall be at the end.

There are fees that can accumulate and become due at the end of the transaction you must be aware of, they are both avoidable – these expenses are divided into two categories.

Over stepping mileage

When your PCP loan agreement starts, you’ll be asked how far you plan to drive the vehicle each year in mileage.

The dealer will use this information to calculate as accurately as possible what the car’s value will be at the end of the contract, allowing them to set your monthly payments and the balloon payment. A car that has been driven sparingly is worth significantly more than one that has logged a lot of miles.

Damage beyond wear and tear

It’s critical to be precise. If you exceed the agreed-upon mileage restriction, the credit firm will charge you between 7p and 10p for each mile you go over. Keep an eye out for this because an additional 2,000 miles will cost you roughly £200 at the end of your PCP term.

The lenders, like any other car rental service, will inspect your returned vehicle for signs of damage. Despite the fact that you are allowed a certain amount of wear and tear from use, the vehicle must be in resalable condition.

This means you’ll have to cover the expense of any visible damage or dents in the car that may reduce its worth.

All lending is subject to status checks and an affordability assessment.

PCH stands for the personal contract hire, PCH is leasing a vehicle that allows you to drive a new vehicle every few years with low monthly payments and not having to worry about the vehicle’s resale value.

“You will not have an option to purchase the car at the end of your agreement.”

Basically, PCH lease allows you finance a new car without having to buy it outright, same as long-term rental. You pay an initial payment that is normally three months upfront then followed by monthly payments until the lease agreement ends, then you return the vehicle back to the leasing company.

“You will not have an option to purchase the car at the end of your agreement.”

Basically, PCH lease allows you finance a new car without having to buy it outright, same as long-term rental. You pay an initial payment that is normally three months upfront then followed by monthly payments until the lease agreement ends, then you return the vehicle back to the leasing company.

- You don’t have to worry about losing money on the vehicles value.

- When the lease agreement ends, hand back the vehicle.

- It’s a very cost-effective way to keep you in a brand-new car.

- Short-term agreement makes it easy to swap into a new car.

- No need for big deposit.

- There’s no MOT for vehicle less than 3 years.

- Flexible contract lengths.

- You’ll have fixed monthly repayments.

- Monthly payments tend to be lower than financing.

- There’s no balloon payment at the end of the lease.

- No large fees at the end of an agreement.

- Excess mileage fees can be expensive if you go far beyond your agreed limit.

- High costs are involved for terminating a lease agreement early.

- You will be charged for any damage to the vehicle that’s not classed as fair wear and tear.

- Ending a PCH lease early will occur extra charges.

- You don’t have the option to own the car.

- Leasing agreements tend to have strict mileage limits with further costs for going over those.

- You’ll need to pay to give the car back before the end of your contract.

“You are tied into the contract for a fixed term just like a mobile contract.”

Although, please note with some finance companies you will have to pay all of the remaining rentals in order to early terminate the vehicle. As finance companies have different forms of contract you do need to check the contract with the credit broker, in order to get the correct calculation.

Leasing and buying a vehicle are two very different approaches in getting yourself behind your desired vehicle.

With PCH Leasing, you pay a small deposit at the beginning then pay a monthly rental fee for an agreed amount of time that is normally between 3 and 5 years but can vary.

At the need of the contract, you hand the vehicle back and you don’t have the option to buy.

“Short-term agreement makes it easy to swap into a new car that you wouldn’t normally be able to afford.”

With buying a vehicle, you take ownership or have the option to do so if you have a PCP finance deal.

Options available when buying a vehicle are:

With PCH Leasing, you pay a small deposit at the beginning then pay a monthly rental fee for an agreed amount of time that is normally between 3 and 5 years but can vary.

At the need of the contract, you hand the vehicle back and you don’t have the option to buy.

“Short-term agreement makes it easy to swap into a new car that you wouldn’t normally be able to afford.”

With buying a vehicle, you take ownership or have the option to do so if you have a PCP finance deal.

Options available when buying a vehicle are:

- Personal Contract Purchase.

- Hire Purchase.

- Bank Loan.

- Cash.

| Features | Cash | HP | PCP | Leasing |

| Deposit Needed | ✘ | ✔ | ✔ | ✔ |

| Fixed monthly payments | ✘ | ✔ | ✔ | ✔ |

| Mileage limiter | ✘ | ✔ | ✔ | ✔ |

| Charges for excess miles | ✘ | ✔ | ✔ | ✔ |

| Depreciation threat | ✔ | ✔ | ✔ | ✘ |

| Own the car during the term | ✔ | ✘ | ✘ | ✘ |

| Option to own the car at the end of the term | ✘ | ✔ | ✔ | ✘ |

| Easy to end the contract after paying 50% | ✘ | ✔ | ✔ | ✘ |

| Different options at the end of the term | ✘ | ✘ | ✔ | ✘ |

| Pay a settlement figure to own the car | ✘ | ✔ | ✔ | ✘ |

| Payments can include the delivery, breakdown, road tax and a warranty | ✘ | ✔ | ✔ | ✔ |

Should you lease or purchase your next vehicle? When it comes to obtaining a new set of wheels, this is a subject you may be considering, and deciding which route is ideal for you.

According to the British Vehicle Renting and Leasing Association, more than 1.3 million vehicles are presently leased on UK roads, indicating that leasing is a popular choice for many.

Advantages of Leasing

According to the British Vehicle Renting and Leasing Association, more than 1.3 million vehicles are presently leased on UK roads, indicating that leasing is a popular choice for many.

Advantages of Leasing

- Monthly payments are lower than finance packages.

- You have short term contracts make it easier to switch into a newer vehicle more regular.

- They are no big cost at the end of the contract.

- You either have the option of owning the vehicle or you’ll own it.

- You shall have no or less mileage restrictions.

- You have the option of returning the vehicle earlier.

- You can’t buy the vehicle at the end of the contract.

- You have mile limits, which can be expensive when going over the limit.

- You have to pay additional cost if returning the vehicle back before end of the contract.

- Your monthly payments will be higher.

- Contracts are longer, newer car less often.

- You will have to occur the depreciation cost.

Leasing a vehicle is cheaper than buying a car but the main disadvantages is like when buying a house, you won’t be paying towards ownership and you will have to keep within strict terms, like not being able to customise to your preference, like new wheels, upgraded sound system, etc.

When buying a vehicle, you need a larger deposit and have larger monthly payments to pay, like a mortgage but you will either own the vehicle or have the option to own the vehicle at the end of the contract.

Whether you should lease or buy a car boils down to your preference. Here are some examples of each scenario:

When it’s best to lease a vehicle:

When buying a vehicle, you need a larger deposit and have larger monthly payments to pay, like a mortgage but you will either own the vehicle or have the option to own the vehicle at the end of the contract.

Whether you should lease or buy a car boils down to your preference. Here are some examples of each scenario:

When it’s best to lease a vehicle:

- You prefer lower monthly payments and a newer vehicle.

- You like a newer car more often.

- You use the vehicle for business, taking advantages of business rates.

- You want to own the vehicle and make modifications.

- You are happy to drive a vehicle for longer.

- You have no mileage limit.

What we do

Our Services

Disclaimer:

Every effort has been made to ensure the accuracy at the time it was written. It is not intended to provide legal advice or suggest a guaranteed outcome as individual situations will differ and the law may have changed since publication.

Readers considering legal action should consult with an experienced lawyer to understand current laws and how they may affect a case.

These Terms apply to your use of our website. If you are not over 18 or not living in the United Kingdom you will not be able to use this website and you should not attempt to make an application, although subject to your acceptance of these Terms you should feel free to browse.

If you do not agree to be bound by the Terms set out below you should not use this website.

If you do not agree to be bound by the Terms set out below you should not use this website.

About Us

We are an established broker working in partnership with selected lenders to bring our clients the financial solution that best suits their needs. From all types of residential or commercial mortgage through to bridging and development finance and onto vehicle, asset and business finance.

Important

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

Leodis Financial is a trading style of Leodis Financial Ltd. Directly authorized and regulated by the Financial Conduct Authority. FRN750327. Office: RHS Rebecca House, Bradford. BD1 2RX Registered Company No: 09865671 | Registered in England and Wales.

2022 – © Leodis Financial – All Rights Reserved