Personal Contract Hire

As experts in the field of vehicle finance, we’ll provide you with all of the

assistance you need to find the best financing options for our customers.

assistance you need to find the best financing options for our customers.

Leodis Financial is an independent broker and lender meaning that we always work

in the favour of the customer and not the manufacturers or car dealers.

in the favour of the customer and not the manufacturers or car dealers.

PCH Lease

“Simple and transparent lease/ hire purchase products.”

As experts in the field of vehicle finance, we’ll provide you with all of the assistance you need to find the best financing options for our customers.

“Leodis Financial is an independent broker and lender meaning that we always work in the favour of the customer and not the manufacturers or car dealers.”

We take pleasure in providing a friendly service through our knowledgeable staff.

-

Direct access to a team of underwriters who will collaborate with you to develop answers.

-

Account managers that are dedicated to assisting you along the process.

“PCH Leasing is the most economical way to drive a new car.”

If you require assistance, we are here to help you.

Need Our Help? Please call us on 01274 028 019

Our UK-based team is ready to assist you throughout the duration of your loan.

Our UK-based team is ready to assist you throughout the duration of your loan.

Contact Us Now.

What is PCH Lease?

PCH stands for the personal contract hire, PCH is leasing a vehicle that allows you to drive a new vehicle every few years with low monthly payments and not having to worry about the vehicle’s resale value.

“You will not have an option to purchase the car at the end of your agreement.”

Basically, a PCH lease allows you to finance a new car without having to buy it outright, the same as a long-term rental. You pay an initial payment that is normally three months upfront then followed by monthly payments until the lease agreement ends, then you return the vehicle back to the leasing company.

Advantages of PCH lease

- You don’t have to worry about losing money on the vehicles value.

- When the lease agreement ends, hand back the vehicle.

- It’s a very cost-effective way to keep you in a brand-new car.

- Short-term agreement makes it easy to swap into a new car.

- No need for big deposit.

- There’s no MOT for vehicle less than 3 years.

- Flexible contract lengths.

- You’ll have fixed monthly repayments.

- Monthly payments tend to be lower than financing.

- There’s no balloon payment at the end of the lease.

- No large fees at the end of an agreement.

Disadvantages of PCH lease

- Excess mileage fees can be expensive if you go far beyond your agreed limit.

- High costs are involved for terminating a lease agreement early.

- You will be charged for any damage to the vehicle that’s not classed as fair wear and tear.

- Ending a PCH lease early will incur extra charges.

- You don’t have the option to own the car.

- Leasing agreements tend to have strict mileage limits with further costs for going over those.

- You’ll need to pay to give the car back before the end of your contract.

If you wish to end the PCH lease agreement term early on a “early termination”, you will have to pay a minimum of 50% of the remaining rentals.

“You are tied into the contract for a fixed term just like a mobile contract.”

Although, please note with some finance companies you will have to pay all of the remaining rentals in order to early terminate the vehicle. As finance companies have different forms of contract you do need to check the contract with the credit broker, in order to get the correct calculation.

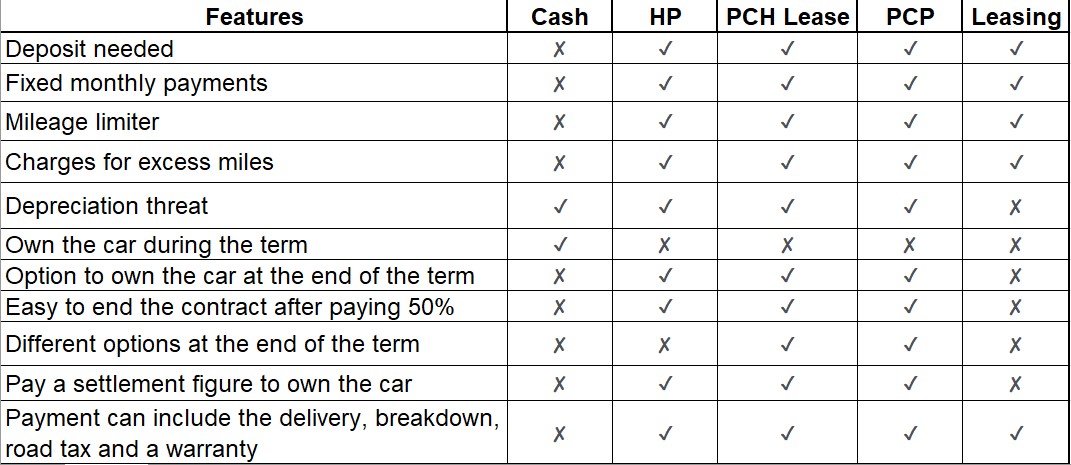

Leasing and buying a vehicle are two very different approaches in getting yourself behind your desired vehicle.

With PCH Leasing, you pay a small deposit at the beginning then pay a monthly rental fee for an agreed amount of time that is normally between 3 and 5 years but can vary.

At the need of the contract, you hand the vehicle back and you don’t have the option to buy.

“Short-term agreement makes it easy to swap into a new car that you wouldn’t normally be able to afford.”

With buying a vehicle, you take ownership or have the option to do so if you have a PCP finance deal.

Options available when buying a vehicle are:

- Personal Contract Purchase.

- Hire Purchase.

- Bank Loan.

- Cash.

Should you lease or purchase your next vehicle? When it comes to obtaining a new set of wheels, this is a subject you may be considering, and deciding which route is ideal for you.

According to the British Vehicle Renting and Leasing Association, more than 1.3 million vehicles are presently leased on UK roads, indicating that leasing is a popular choice for many.

Advantages of Leasing

- Monthly payments are lower than finance packages.

- You have short term contracts make it easier to switch into a newer vehicle more regular.

- They are no big cost at the end of the contract.

Advantages of Buying

- You either have the option of owning the vehicle or you’ll own it.

- You shall have no or less mileage restrictions.

- You have the option of returning the vehicle earlier.

Disadvantages of Leasing

- You can’t buy the vehicle at the end of the contract.

- You have mile limits, which can be expensive when going over the limit.

- You have to pay additional cost if returning the vehicle back before end of the contract.

Disadvantages of Buying

- Your monthly payments will be higher.

- Contracts are longer, newer car less often.

- You will have to occur the depreciation cost.

Leasing a vehicle is cheaper than buying a car but the main disadvantages is like when buying a house, you won’t be paying towards ownership and you will have to keep within strict terms, like not being able to customise to your preference, like new wheels, upgraded sound system, etc.

When buying a vehicle, you need a larger deposit and have larger monthly payments to pay, like a mortgage but you will either own the vehicle or have the option to own the vehicle at the end of the contract.

Whether you should lease or buy a car boils down to your preference. Here are some examples of each scenario:

When it’s best to lease a vehicle:

When buying a vehicle, you need a larger deposit and have larger monthly payments to pay, like a mortgage but you will either own the vehicle or have the option to own the vehicle at the end of the contract.

Whether you should lease or buy a car boils down to your preference. Here are some examples of each scenario:

When it’s best to lease a vehicle:

- You prefer lower monthly payments and a newer vehicle.

- You like a newer car more often.

- You use the vehicle for business, taking advantages of business rates.

- You want to own the vehicle and make modifications.

- You are happy to drive a vehicle for longer.

- You have no mileage limit.

You can check out some of the best Lease offers on our special offers page here: www.leodisfinancial.co.uk

All vehicles come with a manufacturer’s warranty, road tax included with free nationwide delivery.

As an established car leasing broker, we are able to bring you some amazing offers.

If you have any questions about our car leasing offers, then please feel free to call us on 01274 028 019 and one of our team will be pleased to assist you.

What we do

Our Services

Disclaimer:

Every effort has been made to ensure the accuracy at the time it was written. It is not intended to provide legal advice or suggest a guaranteed outcome as individual situations will differ and the law may have changed since publication.

Readers considering legal action should consult with an experienced lawyer to understand current laws and how they may affect a case.

These Terms apply to your use of our website. If you are not over 18 or not living in the United Kingdom you will not be able to use this website and you should not attempt to make an application, although subject to your acceptance of these Terms you should feel free to browse.

If you do not agree to be bound by the Terms set out below you should not use this website.

If you do not agree to be bound by the Terms set out below you should not use this website.

About Us

We are an established broker working in partnership with selected lenders to bring our clients the financial solution that best suits their needs. From all types of residential or commercial mortgage through to bridging and development finance and onto vehicle, asset and business finance.

Important

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

Leodis Financial is a trading style of Leodis Financial Ltd. Directly authorized and regulated by the Financial Conduct Authority. FRN750327. Office: RHS Rebecca House, Bradford. BD1 2RX Registered Company No: 09865671 | Registered in England and Wales.

2022 – © Leodis Financial – All Rights Reserved