-

We shall help you find the right interest rate and package.

-

We work with all the major trusted lenders and banks that consider yourself for the loan, this provides you with the widest chance of being accepted at the lowest rate possible based on your criteria, all in one easy application process!

-

We are an independent broker meaning that we work in the favour of the customer and not the manufacturers or car dealers.

-

We have been authorised and governed by the Financial Conduct Authority to process all our finance applications, providing you with the knowledge you require to make the best financial decision possible.

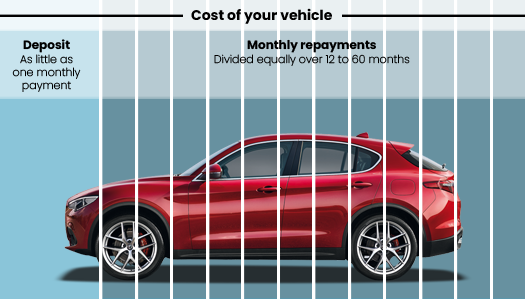

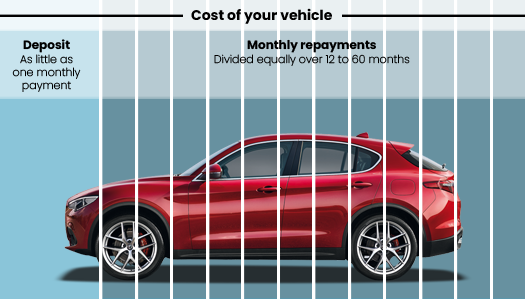

One of the most typical ways to finance a new or used vehicle is through a conditional sale finance package, sometimes known as a Hire Purchase. This is probably the simplest and most straightforward method of vehicle financing.

Because Conditional Finance packages assume you want to own the vehicle at the end of your finance term, it simply divides the total cost of the vehicle (minus your deposit) over the length of your plan – the vehicle is yours after the final monthly payment is made.

The vehicle is yours after the final monthly payment is made.

The vehicle is used to secure the loan amount. Repayments are set for the duration of the contract and are spread out evenly across the term, which can be up to five years. Unless an optional balloon repayment is chosen, there is no big sum to repay at the end of the arrangement.

There are limitations on which vehicles can have a balloon repayment attached; it must be paid at the end of the agreed term.

- If you want to purchase the vehicle after making monthly payments that fits your budget after the length of the agreement, Conditional Sale finance is the way to go.

- No extra charges are occurred because of the mileage, unlike other finance packages.

- There will be no balloon payment at the end of the contract.

- Spread the expense of the vehicle.

- Conditional sales offer flexible deposits and early repayment periods.

Are you seeking for something other than a conditional sale agreement? Maybe a personal contract purchase deal is a better option for you, please look at the other options we have available like PCP.

Conditional Sale Advantages:

- Requires initial deposit

- Fixed monthly payments

- Finance is secured against the vehicle

- Ownership at the end of the agreement

- Early repayment options

- No excess mileage charges

- No Vehicle condition charges (Wear and Tear)

-

Requires initial deposit

-

Fixed monthly payments

-

Finance is secured against the vehicle

-

Flexible ownership at the end of the agreement

-

Early repayment options

-

No excess mileage charges

-

No Vehicle condition charges (Wear and Tear)

- It’s simple to understand and organised.

- Drive a vehicle that you would normally not be able to purchase outright.

- You own the vehicle once all payments are made.

- You don’t need to estimate your mileage at the beginning of the purchase, you’ll be avoiding the excess mileage charges.

- It allows you to stretch the expense of the vehicle over time, allowing you to have a better vehicle than you could with an upfront purchase.

- It’s a flexible agreement with maturities ranging from one to five years.

- The vehicle manufacturer may give a deposit contribution.

- Because the vehicle is considered collateral, HP may be easier to obtain than a traditional loan if you have a bad credit history.

- The vehicle needs to be insured and highly maintained in the owner’s care until the HP finance agreement has been fully paid.

- Monthly payments are higher than other finance options available such as PCP but you shall be paying off the full value of the vehicle.

- You can’t sell and own the vehicle without settling the finance.

- You do not own the vehicle until the final payment is made.

- Monthly payments are higher as compared to leasing and personal contract plans (PCP’s).

- Rates are typically higher than those on normal car loans.

- You can’t modify or sell the vehicle without the financing company’s authorization during the period of your contract.

- Failure to make payments may result in the vehicle being repossessed by the credit company.

- They can do this without a court order until a third of the entire amount is paid.

- If you wish to end the PCH lease agreement term early on an “early termination”, you will have to pay a minimum of 50% of the remaining rentals

- “You are tied into the contract for a fixed term just like a mobile contract.”

- Although, please note with some finance companies you will have to pay all of the remaining rentals in order to early terminate the vehicle. As finance companies have different forms of contract you do need to check the contract with the credit broker, in order to get the correct calculation.

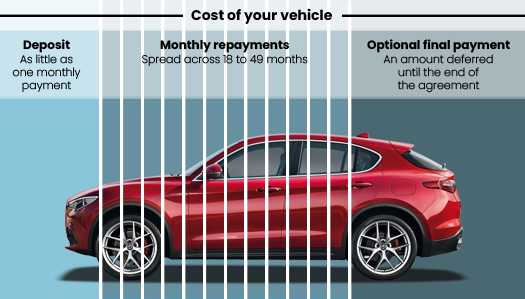

Having a PCP finance agreement gives you the options of affording a newer vehicle with more manageable monthly payments and the options of handing the vehicle back and having nothing else to pay at the end of the contract, the vehicle has to be in good condition, with below the agreed mileage limit and the servicing has to be kept up to date with the vehicles manufacturing guidelines.

If you rather pick the option of buying the vehicle outright, you simply make the optional final payment.

Or, you can trade the vehicle in for a new one, taking advantage of any equity you may have built, should the car be worth more than the optional final payment needed to buy it, can be used as part of the deposit on a newer vehicle.

- Deposit

- Your repayment period

- Optional final payment

- PCP finance enables you to drive the latest and most prestigious car models in the market because only a small upfront fee is required accompanied by fixed monthly payments.

- There is less financial risk with a PCP, you are not paying for the entire cost of the vehicle. As previously mentioned, a PCP only entails a fixed monthly payment on the life of the PCP agreement. At the end of the contract, the final purchase is optional and the car buyer is given the chance to actually own the car by paying a specified sum of money or use it as a deposit for your next car.

- Unlike a loan that requires you to make a down payment, a PCP car lease only requires a small deposit amount.

- You don’t need to worry about selling or disposing your old PCP car when deciding to get a newer vehicle at the end of the contract.

- Car enthusiasts who take pride in vehicle ownership will think twice about a PCP finance deal, as the vehicle is legally owned by the finance company. The car will be yours if you opt to pay the final payment at the end of the PCP agreement. But by this time, new car models are already introduced in the market and a new PCP could be taken advantage of.

- You are entitled to stay within the annual mileage chosen upfront. You will be charged mileage fees for any excess mileage that occurred when you decide not to purchase the car at the end of the PCP agreement.

- You are not allowed to perform modifications to the car unless authorized by the finance company. If you modified the vehicle without permission, you will pay penalty charges if you decide not to buy the car at the end of the PCP agreement.

- There will also be a penalty fee imposed on the PCP agreement if you decide to cancel the contract and return the car.

- Every application is carefully evaluated to ensure that it is within your financial means.

- We evaluate applications based on the information provided by you, the vehicle, and the terms of the agreement.

- Unlike some other brokers, we work with you to offer various financing choices through our lenders.

- We collaborate with Experian, Equifax and TransUnion, the most well-known credit scoring companies on the market.

- If something goes wrong, we’ll be there for you.

- We make motor financing simple, we’ll work with you as your broker to get you in your ideal vehicle. We provide a hassle-free experience from the beginning of your search to the completion of your contract.

- We make motor financing simple, we’ll work with you as your broker to get you in your ideal vehicle. We provide a hassle-free experience from the beginning of your search to the completion of your contract.

- We’ll always be there for you when you need us, we’ll make sure you obtain the right finance product with the best terms. We’ll be here to help you now and in the future. We’re available to discuss whenever you need us if your situation changes.

- Our consumers may be confident that they’re dealing with a company that prioritises customer service; our products and services are tailored to fit the demands of specific consumer groups and are targeted accordingly.

- Before, during, and after the moment of sale, we give our customers precise information and keep them informed.

- When our customers receive guidance, it is appropriate and tailored to their specific needs.

- Our clients receive items that perform as promised, and the associated service is of acceptable quality.

- We do not place excessive post-sale barriers in the way of our customers changing products, switching providers, filing a claim, or filing a complaint.

Our car finance solutions help you achieve your dreams, with finance available for almost any car.

Our varied panel of lenders caters to both new and used vehicles, and our team of professionals will assist you in finding the best financing option for your next purchase.

Choose from our Hire Purchase, Conditional Sale, Personal Contract Purchase or PCH Leasing options, all of which are tailored to your specific requirements.

“Classics, High Performance, Super-cars, Collectibles.”

Our finance deals can be adapted to specific needs and are available for individuals, sole traders, limited corporations, and high net worth individuals, whether you’re searching for an Ferrari or Lada, we can help.

- To identify the correct finance package for you, we’ll talk to a few different funders.

- Service that is quick, polite, and personalised to each vehicle and client.

- Those who desire to change their vehicle more frequently, will appreciate the flexibility.

- Lower rates than dealers, allowing you to stretch your budget.

“We only work with reputable lenders and banks in getting the finest rates possible.”

We work with trusted lenders and banks that consider you for the loan; this provides you with the widest chance of being accepted at the lowest rate possible based on your criteria, all in one easy application process!

Please contact us as soon as possible if you find yourself in this situation on 01274 028 019. Our knowledgeable staffs are available to assist you, and we’ll work with you to find the right solution.

Leodis Financial is a trading style of Leodis Financial Ltd. Directly authorized and regulated by the Financial Conduct Authority. FRN750327. Office: RHS Rebecca House, Bradford. BD1 2RX Registered Company No: 09865671 | Registered in England and Wales.

- Mortgage Calculators

- Vehicle Refinance

- Vehicle Finance

- Vehicle Leasing

- Commercial Mortgage

- Bridging Loan

- Buy To Let

- Development Finance

- Second Charge

- First Time Buyer

- Poor Credit Mortage

- Building Insurance

- Mortgage Protection

- Life Assurance

- Business Protection

- Asset Finance

- Capital Release

- Invoice Financing

- FAQs

- Forms

- Commercial Finance

- Residential Mortgage

- Homeowner

- Specialist Finance

- Insurance

- Business Finance

- Asset Finance

- Tax Relief

- Invoice Financing

- Vehicle Finance

- Mortgage Calculators

- Vehicle HP Calculator

- Vehicle PCP Calculator

- Mortgage Forms

- Bridging Loan Form

- Buy To Let Forms

- Second Charge Forms

- Commercial Forms

If you do not agree to be bound by the Terms set out below you should not use this website.